PROBATE

REMEMBER: A WILL ALONE DOES NOT KEEP YOUR ESTATE OUT OF PROBATE COURT

When someone passes away, their estate may be subject to a court-managed process called probate. The decedent’s assets are managed and distributed through this process. A well drafted and properly funded trust will allow the named successor trustee to administer your estate outside the probate process.

The length of time needed to complete the probate of an estate depends on the size and complexity of the estate and the local rules and schedule of the probate court.

Placer and Sacramento counties are setting hearings at least 6 weeks from the date of filing the petition. When there is a house to sell you will not have authority to do so until after the first hearing. You may also not have access to any bank accounts of the decedent until after the first hearing. A common question is: How will the bills be paid and who is responsible for upkeep of the decedent's home?

When someone passes away, their estate may be subject to a court-managed process called probate. The decedent’s assets are managed and distributed through this process. A well drafted and properly funded trust will allow the named successor trustee to administer your estate outside the probate process.

The length of time needed to complete the probate of an estate depends on the size and complexity of the estate and the local rules and schedule of the probate court.

Placer and Sacramento counties are setting hearings at least 6 weeks from the date of filing the petition. When there is a house to sell you will not have authority to do so until after the first hearing. You may also not have access to any bank accounts of the decedent until after the first hearing. A common question is: How will the bills be paid and who is responsible for upkeep of the decedent's home?

|

The probate process generally includes the following:

• Filing a Petition to appoint Executor (in the case of a Will) or Administrator for the estate. • Notice to heirs under the Will or to statutory heirs (if no Will exists) • Publication of the Petition in a local newspaper • Inventory and appraisal of estate assets by Executor/Administrator and by the court probate referee. • Payment of estate debt to rightful creditors. • Sale of estate assets. • Payment of estate taxes, if applicable. • Final distribution of assets to heirs. |

“Non-Probate Assets”

Probate is a process through which title is transferred from the name of the decedent to the name(s) of the beneficiary/es. Some assets, called “non-probate assets”, do not go through probate.

Probate is a process through which title is transferred from the name of the decedent to the name(s) of the beneficiary/es. Some assets, called “non-probate assets”, do not go through probate.

|

These include:

• Property in which you own title as “joint tenants with right of survivorship”. This titling allows the property to pass to the surviving owner by operation of law. • Accounts where there are designated beneficiaries, such as Retirement accounts: IRA & 401(k) • Life insurance policies with proper beneficiary designations • Bank accounts with “pay on death” (POD) designations or “in trust for” designations • Property held in a trust. Legal title to such property passes to successor trustees without having to go through probate. Payment of Executor

Executors are reimbursed for all legitimate out-of-pocket expenses incurred in the process of management and distribution of the decedent’s estate. In addition, you may be entitled to statutory fees, which is based on the size of the probate estate. The Executor has to fulfill his or her fiduciary duties on behalf of the estate with the highest degree of integrity and can be held liable for mismanagement of estate assets in his or her care. It is advised that the Executor retain an attorney and an accountant to advise and assist him with his or her duties. |

|

The Cost of Probate

The cost and duration of probate can vary substantially depending on a number of factors such as the value and complexity of the estate, the existence of a Will and the location of real property owned by the estate. Will contests or disputes with alleged creditors over the debts of the estate can also add significant cost and delay. Common expenses of an estate include executors’ fees, attorneys’ fees, accounting fees, court fees, appraisal costs, and surety bonds. Most estates are settled though probate in about 9 to 18 months, assuming there is no litigation involved.

The cost and duration of probate can vary substantially depending on a number of factors such as the value and complexity of the estate, the existence of a Will and the location of real property owned by the estate. Will contests or disputes with alleged creditors over the debts of the estate can also add significant cost and delay. Common expenses of an estate include executors’ fees, attorneys’ fees, accounting fees, court fees, appraisal costs, and surety bonds. Most estates are settled though probate in about 9 to 18 months, assuming there is no litigation involved.

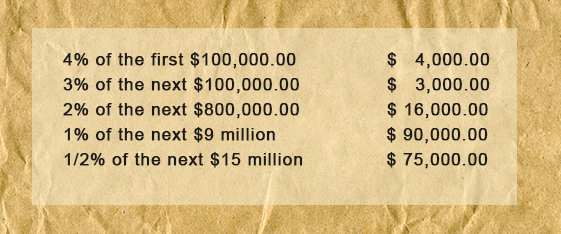

Probate fees are set by law. As of 2013, California Probate Code Section 10800 sets the fees as follows:

Additional costs include:

- Filing Fees: $435.00 for the initial filing fee, $435.00 to close the estate

- Bond: A surety bond may be required unless waived by the Will or all beneficiaries

- Publication: approximately $200.00 to publish the Notice of Petition to Administer Estate

- Probate Referee: the fee for the probate referee appraisal (depends on size of estate)

- Certified copies of court orders, letters are extra ($25.00 per copy)

Objections to the Will

An objection to a Will, also known as a “Will contest” can be incredibly costly to litigate.

In order to contest a Will, one has to have legal “standing” to raise objections. This usually occurs when, for example children are to receive disproportionate shares under the Will, or when distribution schemes change from a prior Will to a later Will. In addition to disputes over the tangible distributions, Will contests can be a quarrel over the person designated to serve as Executor.

An objection to a Will, also known as a “Will contest” can be incredibly costly to litigate.

In order to contest a Will, one has to have legal “standing” to raise objections. This usually occurs when, for example children are to receive disproportionate shares under the Will, or when distribution schemes change from a prior Will to a later Will. In addition to disputes over the tangible distributions, Will contests can be a quarrel over the person designated to serve as Executor.